No loans included are currently classified as substandard, doubtful, or loss, either internally or by a regulator.No construction or operating loans are included.The borrower of collateral pledged is not an officer, director, attorney or agent of the customer.No collateral pledged is 60 days or more past due, on nonaccrual or in foreclosure.The collateral pledged was originated by customer, and is serviced and owned by the same, and therefore is not encumbered by any prior lien, pledge, participation, or any other form of encumbrance.This solution can be ideal for small importers who have booked a large purchase order and need funding to pay their foreign suppliers. If they meet the funding criteria, the company will provide the funding and enable you to fulfil the order. The finance company will look at the credit quality of your purchase order, the track record of your supplier and your experience executing similar orders. The main advantage of using po financing is that you can finance orders based on the strength of the order itself.

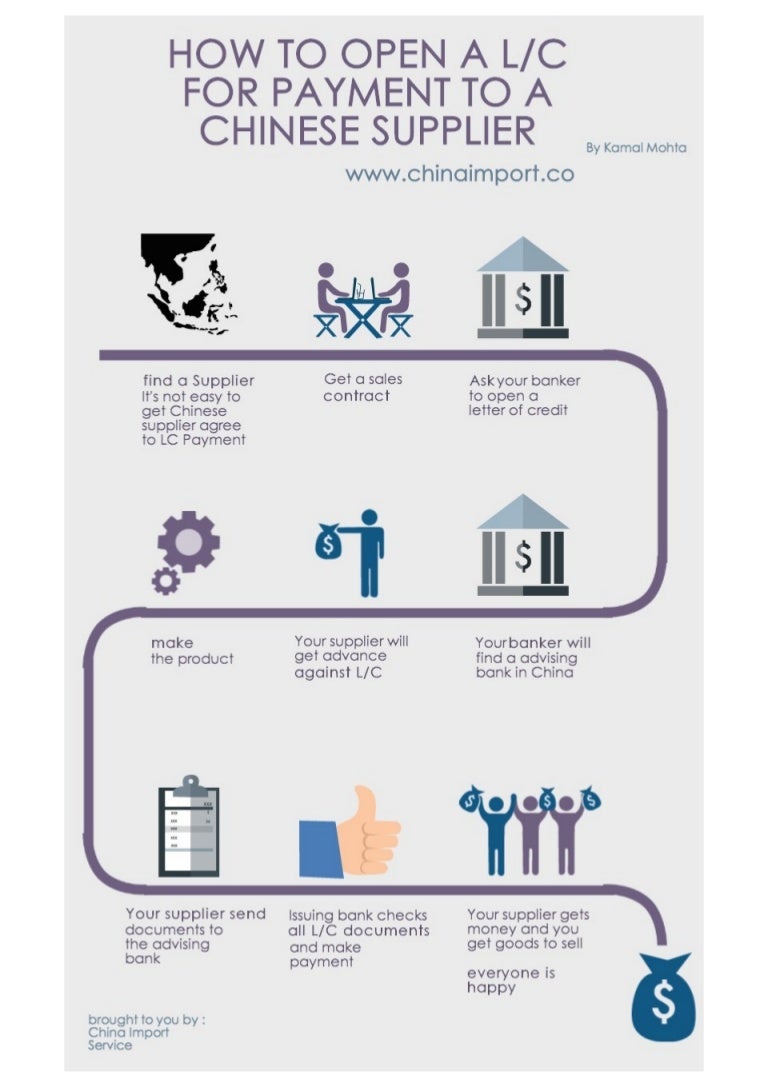

You can also read these articles to learn more about the product advantages and the qualification criteria. Here is an article that has more details on purchase order financing and how it works. The transaction concludes once your end customer receives the product and pays for it. This enables you to make the purchase from your supplier. A finance company uses your order as collateral and opens a letter of credit on your behalf. One alternative that has been gaining popularity as a way to solve this problem is to use a supplier financing technique known as purchase order funding.Īs it name implies, the solution provides financing based on existing purchase orders. If your company just got a large order - one that exceeds your capitalization - you will need to come up with the funds, or risk losing the order. The biggest problem that buyers have with letters of credit is that banks require the cash collateral up front. This is common in Asian countries that have factories that are growing quickly. Furthermore, many foreign suppliers can take a letter of credit and actually get financing against it. Payment is often made contingent to a successful inspection.Īlthough using a letter of credit adds complexity to the transaction, you can see how it reduces the risk for all parties. It's common for letters of credit to contain an inspection clause, where you hire a third party inspection company that looks at a sampling of the goods and ensures they meet your specifications. Once the bank has the collateral, they will write the letter of credit so that your supplier is guaranteed a payment (by the bank) as long as they meet: Collateral can be provided in cash, or can be debited from an existing line of credit if you have one. The bank will ask you to post collateral to cover the amount of the L/C. You can get a letter of credit from your bank and they come in many types - revocable, irrevocable, transferable and standby. This is a common scenario in foreign transactions that can be addressed with a letter of credit. On the other hand, you only want to pay the supplier once you have received and inspected the widgets to ensure they meet your criteria. Although you have been working with your Chinese supplier for a little while and they know you, they still insist on being paid up front for the goods. Now, your company does not manufacture the widgets, but rather, it imports them from China and resells them.

Let's assume that you just got a large order for widgets from a large customer. If the letter of credit is written correctly it will ensure that the buyer gets the products they are purchasing and that the supplier gets paid for their product. They are very common when importing goods, where the buyer and the seller are in different countries. A letter of credit is a financial instrument that is designed to protect all parties in a purchase transaction.

0 kommentar(er)

0 kommentar(er)